Shopper traffic to physical retail stores has strongly rebounded from 2020. Data from Placer.ai, a company which measures shopper visits across a wide range of physical stores including grocery, apparel, big box, department and specialty, indicate that shoppers returned for the 2021 holiday season.

Store visits were higher than 2020 and slightly ahead of 2019

Ethan Chernofsky, vice president marketing of Placer.ai, discussed how retailers were simultaneously concerned that supply chain issues would lead to a lack of products in stores, labor shortages would limit professionals to staff those same locations and COVID would impact consumer demand for in-store visits. And while the effects of all of these issues were felt, overall retail holiday visits for 2021 still remained relatively close to, if not above, 2019 levels and far ahead of 2020 numbers.

Chernofsky said, “The ability to drive success even in the face of a ‘perfect storm’ of challenges is a massive testament to the ongoing consumer demand for physical retail. While the sector is clearly evolving in a direction that demands greater omnichannel alignment, the continued centrality of the physical store received a major vote of confidence over the holiday retail season.”

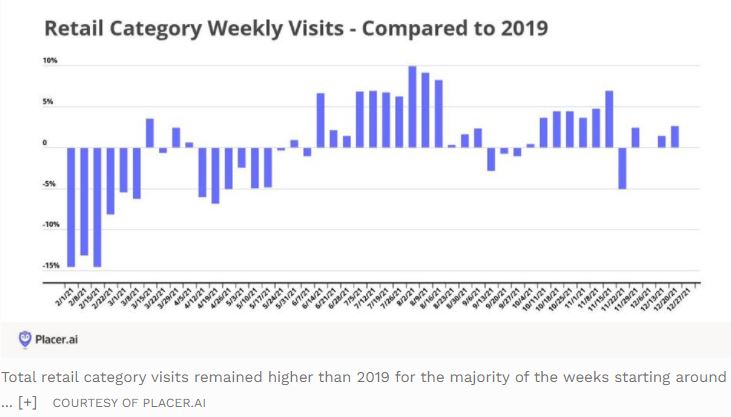

Retail category weekly visits (including all retail categories measured by Placer.ai), began trending up in June of 2021. With the exception of a few weeks, the upward trend compared to 2019 continued throughout the holiday season. Placer.ai data includes grocery, big box, specialty stores and department stores among other segments.

Strong holiday sales and foot traffic were experienced across many retailers as compared to last year and were moderately improved from 2019. However, many retailers calculate the holiday selling period from November to December (the six weeks from Thanksgiving through New Year’s Day). In 2021 many holiday sales and shopping visits took place in October.

October showed strong performance for retail stores as shoppers were worried about product shortages due to supply chain issues and high consumer demand, along with minimizing the stress of the holiday season by shopping early. Many customers were apprehensive about going back into crowded stores due to ongoing COVID concerns. Chernofsky said, “Visits for many top retailers were up significantly in October as many visitors made an effort to get holiday shopping done early to ensure having their products on time.” Best Buy, Target and Dick’s Sporting Goods all showed significant increases in holiday traffic compared to 2019.

Forbes.com, Shelley E. Kohan

To read the full article, click here…