Geopolitics, The Fed and COVID Policies Will Decide Economic Future

According to economist Bernard Baumohl, one of the top questions pending for the fate of the U.S. economy and the hotel industry is just how far the Federal Reserve is willing to push its plan to raise interest rates and tamp down inflation.

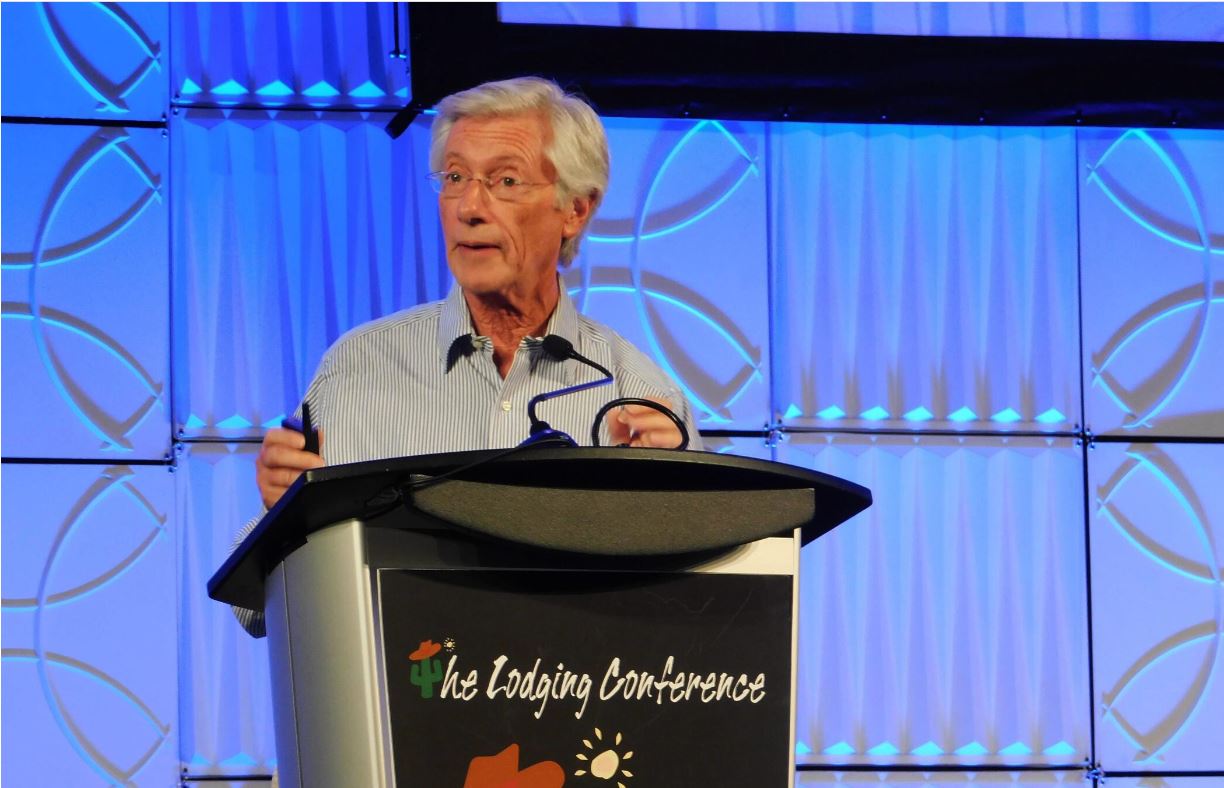

Speaking during the “Economic Outlook” session at The Lodging Conference, Baumohl, chief global economist for The Economic Outlook Group, said he believes the Fed has likely already done enough, and inflation is already on the path to cooling.

“What we are now beginning to see already in some of the data is an inflection point on inflation and the beginning of what we suspect will be a long-term downward trajectory on inflation,” he said. “I think the worst is over.”

While very few people believe the Fed is ahead of the curve, Baumohl said the primary issue now is less about inflation and more about the mindset of the Fed.

Baumohl identified Fed policy as one of three primary determiners of economic growth in 2023 and 2024, along with the broad geopolitical outlook — headlined by Russia’s invasion of Ukraine — and how countries across the globe will continue to approach COVID-19 policies.

Ultimately, the most likely scenarios for the economy — including falling gas prices, a stabilizing labor environment and the dollar losing some value — will culminate in a strong travel outlook for the next two years. He said that’s likely to remain true even in the face of a recession.

CoStar.com, by Sean McCracken