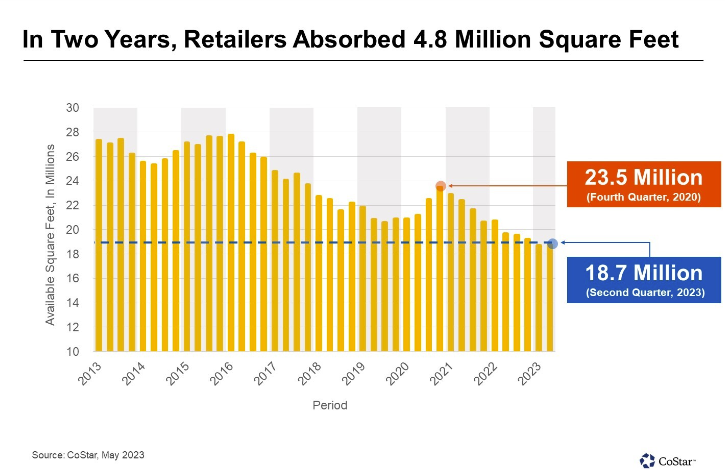

In a recent CoStar article, Brenda Nguyen points out that despite concerns about the impact of online shopping and the pandemic, Philadelphia retailers have seen a different outcome in terms of leasing performance. The retail space available in the Philadelphia region currently stands at 18.7 million square feet, which is 20% lower than the peak during the pandemic and 11% lower than pre-pandemic levels.

Consumer spending and e-commerce sales have reached new heights in recent years, thanks to significant individual discretionary savings and low-interest loans provided by the government’s Paycheck Protection Program. Retail companies have taken advantage of this demand surge by expanding their operations and opening new locations across the country, including in Philadelphia.

Since 2020, there has been an increased demand for home improvement, discount, grocery, fitness, and entertainment products and services in the region. Retail has adapted to changing customer preferences and demographic shifts, with a particular focus on health and experiential offerings. Recent leasing activities have reflected this trend, with a significant number of leases being signed for spaces under 10,000 square feet, such as fitness studios, physical therapy offices, hair and beauty salons, and fast-casual food services.

Notable retail leases in 2023 include Monaco Indoor Karting’s lease in Berlin, New Jersey (70,100 square feet), Weis Markets’ lease in Middletown, Delaware (64,000 square feet), and Total Liquidators’ lease in Lansdale, Pennsylvania (32,000 square feet). Additionally, at least 25 out of 620 retail leases signed in the past six months were for spaces exceeding 10,000 square feet. This leasing momentum continues to reduce available retail space, bringing the inventory in the Philadelphia region to its lowest levels since 2006.